As a data professional in the consumer banking sector, you are constantly faced with the challenge of managing and transforming large amounts of data. Streamlining this process can significantly enhance your productivity and the effectiveness of your outcomes. One tool that is proving to be quite instrumental in this regard is the data build tool, better known as dbt. In this article, I will be introducing you to the power of dbt and how it can be used to generate cross-sell leads more efficiently.

Trends and Insights: The Future of Data Transformation in Consumer Banking

In today’s digital era, the way we approach data is transforming rapidly, especially in the realm of consumer banking. The sector is witnessing a tectonic shift in the way data is processed, managed, and consumed. Such advancements are enabling banking professionals to make more informed decisions, streamline operations, and enhance customer experiences.

One of the most significant trends in this space is the shift towards automated data transformation. The days of manual data wrangling are being phased out, replaced by sophisticated tools that can automate data cleaning, transformation, and analysis. This not only improves accuracy but also significantly reduces the time spent on data management.

Another noteworthy trend is the adoption of self-service data transformation tools. As the demand for real-time data insights grows, there is a pressing need for tools that empower non-technical users to transform and analyze data independently. This trend, in turn, is fostering a data-driven culture within organizations, where each decision is backed by data-derived insights.

The rise of data build tools like dbt (data build tool) is a testament to this evolution. dbt is a command-line tool that enables data analysts and engineers to transform raw data stored in data warehouses into a more usable, business-friendly format. This tool is gaining traction for its ability to facilitate code collaboration, version control, and much more.

Finally, data visibility and traceability are becoming increasingly important. As a banker, wouldn’t it be beneficial if you could track the history of a data point from its origin to its current state? This is precisely what modern data transformation tools enable, offering comprehensive data lineage features. They allow you to understand how data has been manipulated, offering transparency and accountability.

These trends underscore the profound impact of data transformation tools on consumer banking. They are not just changing how banks handle data, but also the very fabric of decision-making processes in the banking sector. As we delve deeper into this subject, let’s look at a compelling case study of dbt’s application in generating cross-sell leads.

How dbt Transformed Cross-Sell Lead Generation for Banks

In the ever-expanding sea of consumer banking, the key to maintaining a competitive edge lies partially in the ability to effectively generate cross-sell leads. This is where the importance of leveraging your existing customer portfolio comes into play. Specifically, focusing on credit card customers, which is often the largest credit portfolio of all banks, as a starting point can pave the way for identifying potential customers for other lending products such as personal loans or mortgages.

However, the struggle of generating these qualified leads arises from the need to integrate data from various sources. These sources include demographic information, credit performance, and credit policies, all of which exist in different formats. The traditional method that banks employ involves extracting this data from various systems using SQL, transforming it, and then exporting it to Excel files for further aggregation and transformation. This process contains those pitfalls:

– Data Latency: Delays in data processing can seriously impact the timely identification and approach of potential cross-sell leads.

– Labor Intensity: The process of manually extracting, transforming, and aggregating data is extremely time-consuming and resource-intensive.

– Error Prone: Manual data handling increases the risk of errors, which can lead to misguided decision-making and missed opportunities.

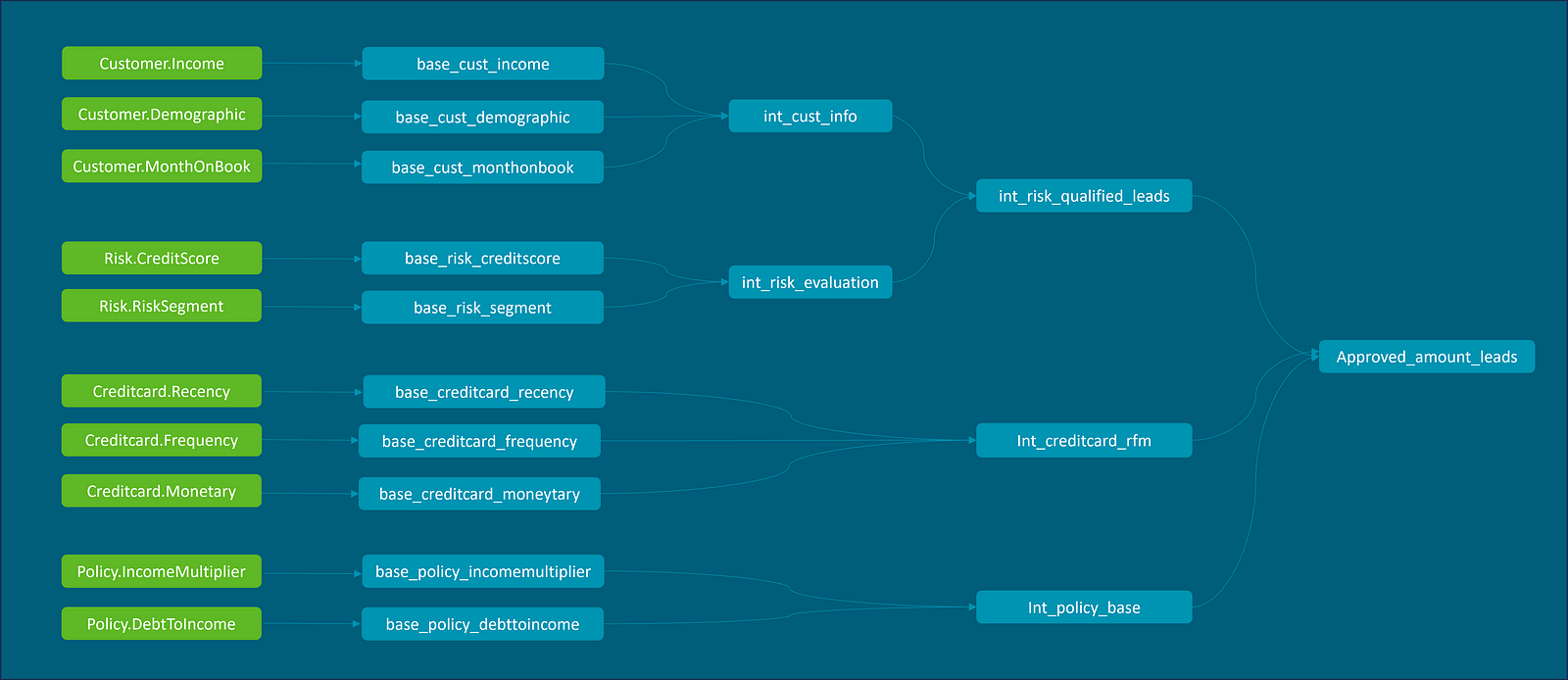

The primary function of dbt (data build tool) that makes it invaluable in this context is its ability to construct data models. This is achieved by breaking down a monolithic SQL script into manageable, comprehensible modules. Imagine the convenience of being able to work with modules instead of getting entangled in a single, complex SQL script. Doesn’t that sound like a breath of fresh air?

dbt significantly enhances the clarity and reusability of your SQL scripts. It is a game changer in the world of data transformation. In more concrete terms, dbt offers a plethora of benefits. Shall we delve into these?

– Clarity: By breaking down your SQL scripts into modules, dbt brings much-needed clarity to your data models. Gone are the days when you need to navigate through a single, extensive script. Instead, you can focus on individual pieces, making your work much simpler and less error-prone.

– Reusability: Once your SQL scripts are modularized, they become readily reusable. This means you can leverage a piece of script in multiple scenarios, enhancing your efficiency and productivity.

A key advantage of dbt is its SQL-centric nature. If you are familiar with SQL, you’re already equipped to use dbt. It allows you to write transformations as SQL SELECT statements, making it easier to understand and maintain the transformation logic.

Why is dbt the ideal tool for this use case?

First, dbt follows the principle of code over configuration. This means that instead of relying on a GUI or a series of checkboxes, you write code to define your data transformations. The code you write is in SQL, a language that most data analysts are already proficient with, reducing the learning curve and facilitating easy adoption.

Eliminating Manual Data Transformation

Manual data transformation through platforms like Excel and monolithic SQL scripts are common practices in many banks. However, this method is not without its pitfalls. It may initially seem convenient and straightforward, but as the complexity and volume of data grow, so do the challenges.

– Time-Consuming: The first and most obvious challenge is the time investment. Pulling, cleaning, transforming, and loading data manually is a labor-intensive process that can eat up significant chunks of your workday.

– Error-Prone: When dealing with large volumes of data, the risk of errors increases exponentially. A single mistake in a formula or a missed data point can drastically skew your results.

dbt provides a robust solution to this problem.

By using dbt (data build tool), you can streamline the usually laborious and time-consuming process of manual data transformation in consumer banking. So, how does dbt achieve this efficiency?

The answer lies in its ability to write business logic faster using a declarative code style. This style allows you to outline what you want to achieve without explicitly detailing how you want it done. The tool then applies your instructions, saving you the hassle of writing lengthy, complex codes.

With dbt, you’re not just coding; you’re declaring your intentions. The tool does the heavy lifting for you.

Enhancing Visibility on Data Lineage

Understanding the origins and transformations of your data is crucial for ensuring data integrity. Dbt enhances visibility on data lineage, providing a clear view of where the data came from and how it was transformed.

In the world of consumer banking, the ability to accurately track data lineage is of paramount importance. It allows for a comprehensive overview of data sources, transformations, and destinations, providing much-needed insight into the effectiveness of data strategies. However, before the advent of the data build tool, or dbt, this task was often fraught with complexity and inefficiency.

With dbt, you now have a powerful tool at your disposal that streamlines the process of tracking data lineage. Gone are the days of manual, error-prone methods. Dbt automates this process, ensuring accuracy and reliability while saving you time and resources.

Testing data accuracy quickly with out-of-the-box features

Accurate data is critical in the banking sector. Even a minor data discrepancy can lead to significant errors in cross-selling. By using dbt’s testing capabilities, you can ensure the highest level of data accuracy and integrity.

One major advantage of dbt is its robust testing framework. This allows you to ensure data accuracy swiftly using out-of-the-box generic tests that cover a broad range of common data testing scenarios. These tests can be implemented quickly and easily, drastically reducing the time spent on data validation, such as:

– Uniqueness: Ensuring that a field has unique values.

– Not-null: Checking that a field does not contain null values.

– Referential integrity: Making sure that relationships between tables are properly maintained.

For more complicated checks, dbt allows you to create customized tests. This flexibility lets you tailor your data tests to suit your specific needs, accommodating complex data structures and relationships.

Documenting Changes through Version Control

Another crucial feature of dbt is its ability to document changes through version control. If you’ve ever found yourself struggling to understand why a particular data transformation was made, or who made it, dbt’s version control feature will be a game-changer for you.

With dbt, every change made to your data is meticulously documented and stored. This not only provides a clear record of changes, but also allows you to revert to previous versions if necessary. And the best part? This all happens automatically, without you having to lift a finger.

As a result of these features and more, dbt is revolutionizing the way data professionals in the banking industry manage and transform their data. It’s not just a tool, it’s a catalyst for change, driving efficiency and empowering professionals like you to do more with your data.

In conclusion, dbt has emerged as a powerful tool for banks, streamlining the process of generating cross-sell leads. By simplifying data integration, automating data transformation, enhancing visibility on data lineage, and enabling efficient version control, dbt is helping banks achieve higher efficiency and accuracy in their lead generation processes.

Empowering Bankers with dbt for Efficient Data Management

As we’ve delved into the diverse applications of dbt (data build tool) for streamlining the process of generating cross-sell leads in consumer banking, its indispensable role has become increasingly evident. This tool doesn’t simply add a touch of convenience — it’s a game-changer.

dbt’s core strengths lie in its ability to document changes, maintain data quality and security, and deal with change. Through practical, real-world case studies, we have seen how dbt has transformed cross-sell lead generation for banks, revolutionizing how they approach data transformation.

As we wrap up, it’s important to recognize that implementing and mastering dbt is not a one-off event — it’s an ongoing process. As with any powerful tool, the true value of dbt is unlocked over time, through steady use and continuous learning.

So here’s to the future of consumer banking — a future where data transformation is streamlined, efficient, and fundamentally empowering. We hope you’re as excited about this future as we are!

References

Here are some important resources that were instrumental in writing this article. They provide more in-depth information on dbt (data build tool) and its advantages in streamlining the process of generating cross-sell leads in consumer banking. I encourage you to delve deeper into these materials to gain a more comprehensive understanding of the subject matter:

– dbt is an open-source tool that has a growing community of users and contributors.

- Using dbt to Streamline Cross-sell Leads in Consumer Banking + Case Study - September 7, 2023